We start to shift the weather pattern a bit next week; but even then there’s been some discrepancy on how that evolves. There’s clear consensus on the cold retreating Wednesday of next week.

The first divide in the road comes with a system next weekend. The Euro tries to bring a disorganized low pressure up the coast, while the GFS has a strong cold front blasting through — however in both solutions we now see a pocket of cold coming in for Monday/Tuesday of Thanksgiving week.

I chose to do a written blog this evening because there were multiple visuals to show at the same time contextualizing the complexities of our long range.

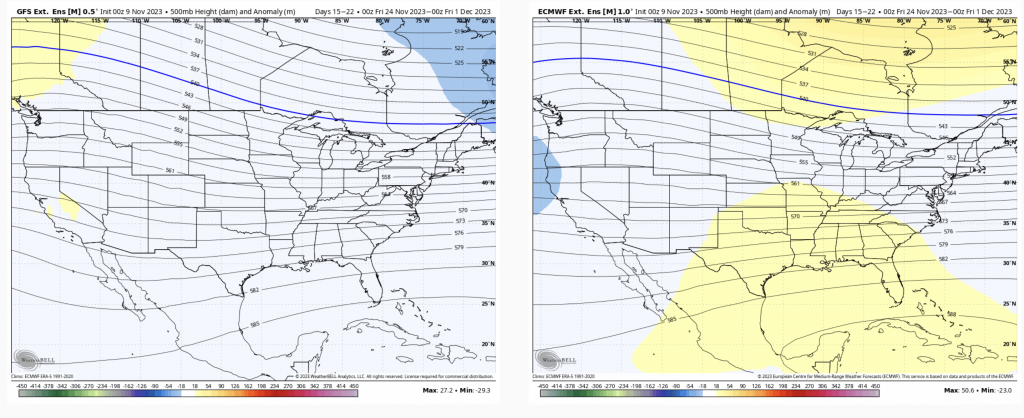

The first below is the GFS Extended & Euro Extended that came out in the 0z runs 11/9 /23.

Both have a western trough, and varying degrees of an eastern ridge for 11/17-11/24 (GFS on left, Euro on right).

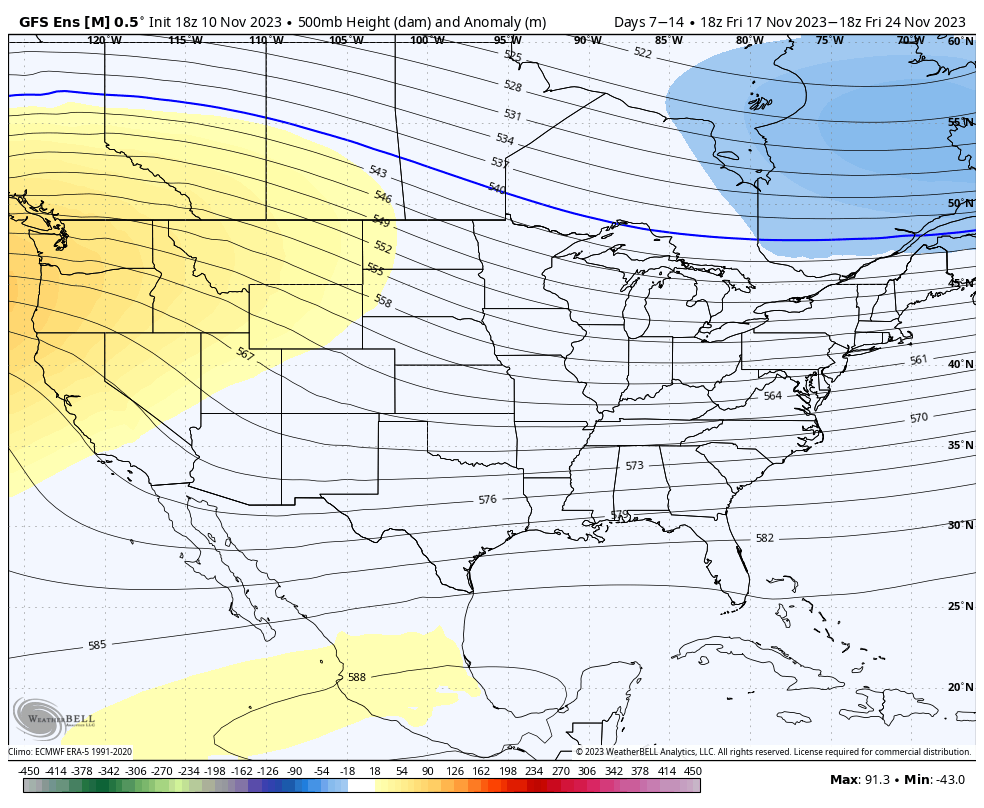

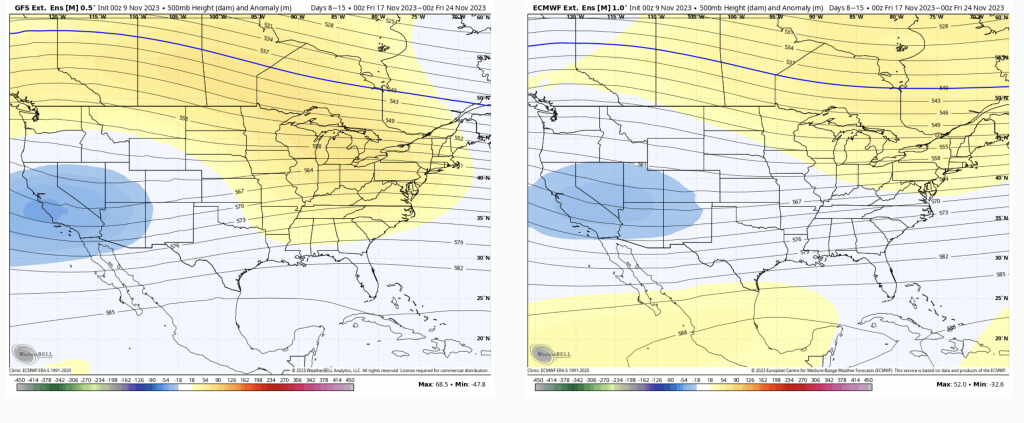

Next is the same map — 500mb height anomalies of the GFS & Euro Ensembles from 12z today, 11/10 (my apologies, the GFS/Euro are flipped — Euro is left/GFS is right)

The GFS has completely flipped its thinking in Days 7-14 with an eastern trough and western ridge. The Euro has significantly moved the trough east, and the eastern ridge is flattened out.

The bias of the western trough/eastern ridge seems to be fairly prevalent in the Euro in the Day 10-17 range heading into the winter season. It had the same idea at the end of October, whereas the GFS saw the cold snap we are in now.

All this to say…I’m not putting a lot of stock into the long range beyond Day 14, if we’re seeing this type of flip in 36 hours. In addition, don’t rule out the GFS in the long range right now. We know the Euro has a warm bias in the long range, but a warm bias and a completely opposite global pattern are very different matters.

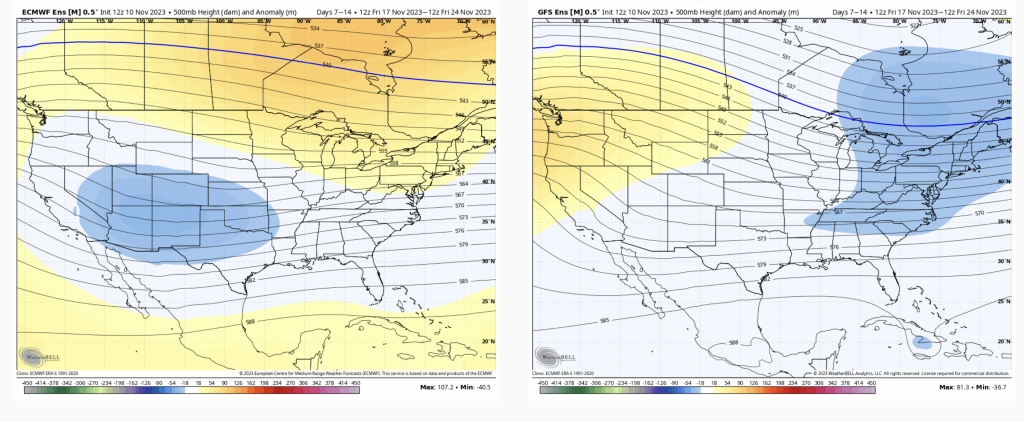

Not surprisingly, the Day 14-21 map is fairly flat and zonal; and the GFS holds the colder solution while the Euro is slightly warmer, trying to develop the eastern ridge. Taking this with a grain of salt…