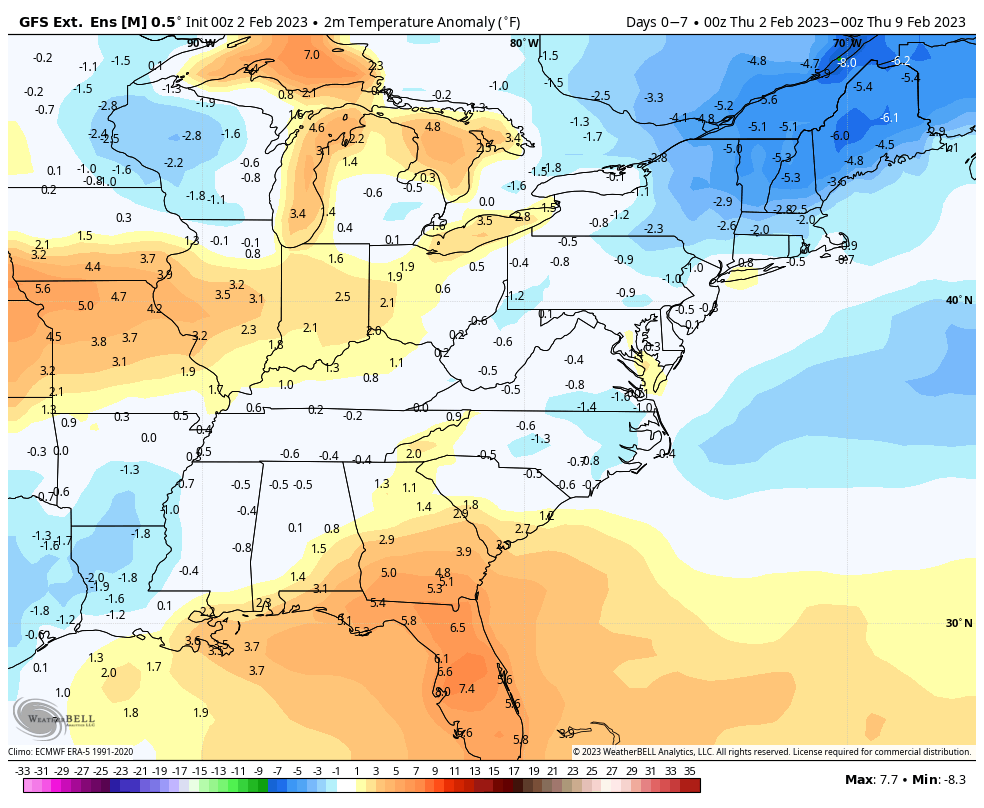

As with any major arctic outbreak, a swing to the other end is inevitable. However, we do have two differing opinions on the outcome. The GFS is slightly more on top of the temperature trends. If you look at last week’s long term trends for Days 7-14, and compare to the current 0-7 Days, both models are overly cold. However, the GFS nails the FL warmth, a greater expanse of the cold in the Northeast, and less cold (focused in WI) in the western Great Lakes.

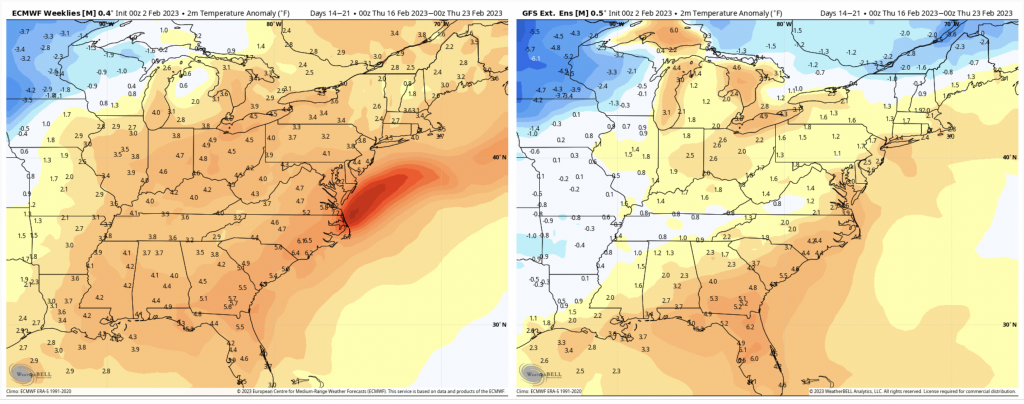

Going into Days 7-14, we will see above average temperatures overall, but we’ll still have decent fluctuation in temperatures with the pattern reactivating.

Overall, expect temperatures to run 3-6 degrees above average for this point in the year.

The Euro is a little warmer than the GFS projection, and also is slower to see the warmth retreat. However, the GFS better matched overall temperature patterns in the last 2 weeks, and therefore I’m going to hedge slightly toward that outcome.

The Euro does cool down eventually, but right now looks 3-4 days behind the GFS projection. What this means is that we should be seeing a cooler trend heading into the February vacation weeks.