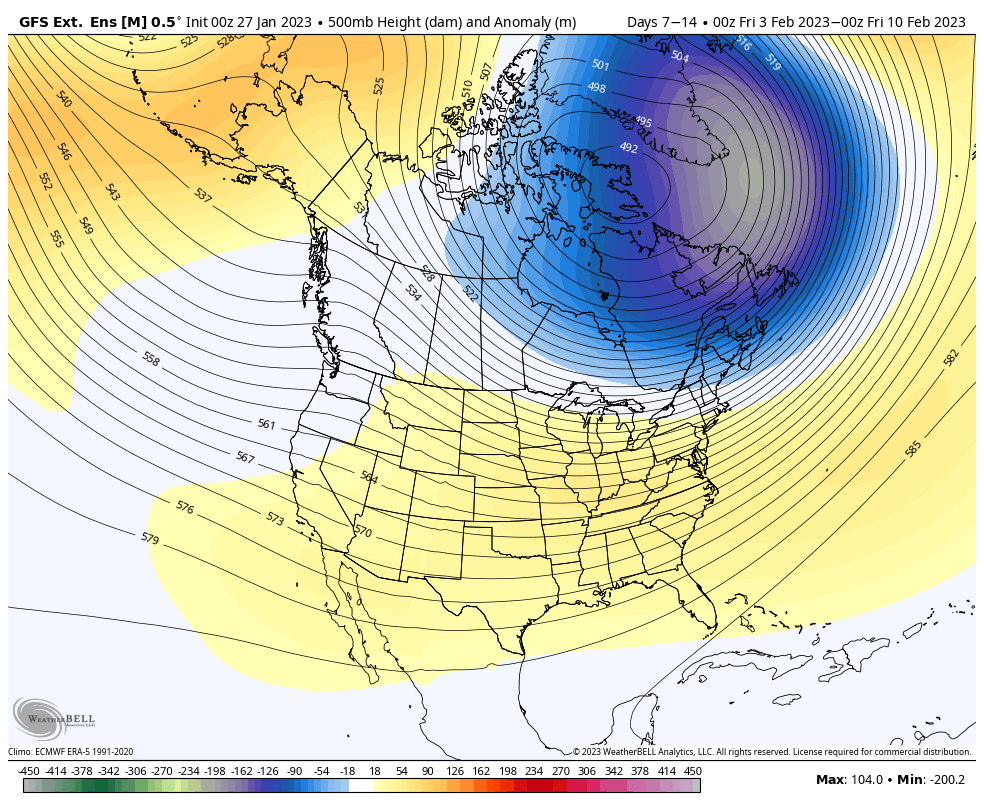

There’s a couple discrepancies in the long range that have some implications to the forecast, but overall we’re in a relatively cooler pattern.

I’m going to post both the GFS Extended and the Euro Weeklies together to more easier show the comparison for Days 7-14 and then Days 14-21.

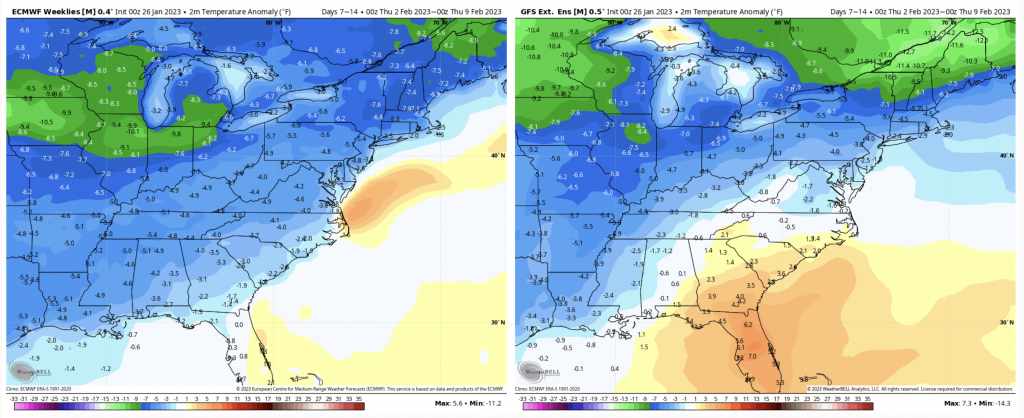

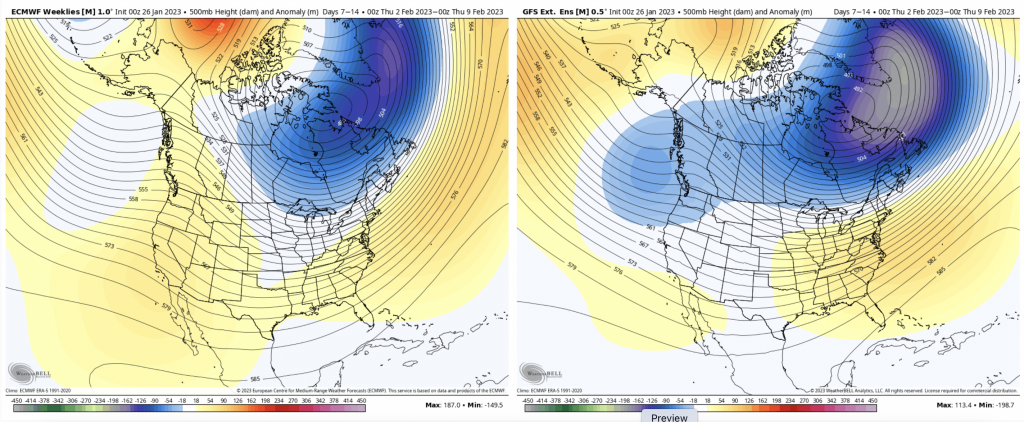

Days 7-14:

There are quite a few differences here – the Euro (left) is going with an overall cooler flow across most of the eastern United States. The GFS (right) is strong with the cold intrusion and keeps the warmth in the SE. Overall it’s a cool 7 days for us.

You can see that the GFS is deeper with the trough in the Canadian Maritimes, and there’s also a difference in the Pac NW – the GFS solution doesn’t quite make sense meteorologically, so it’s hard to run with that. Overall I think we’ll start to get back into an active pattern during the second week of the month as the arctic air retreats.

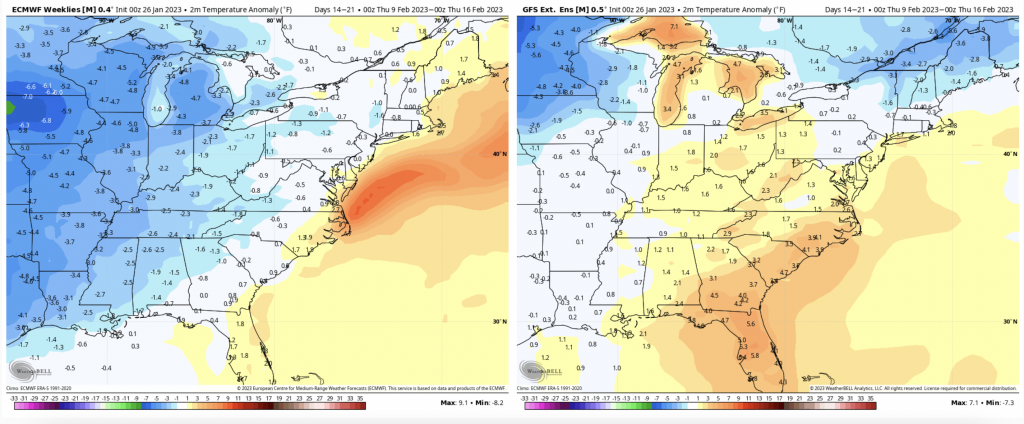

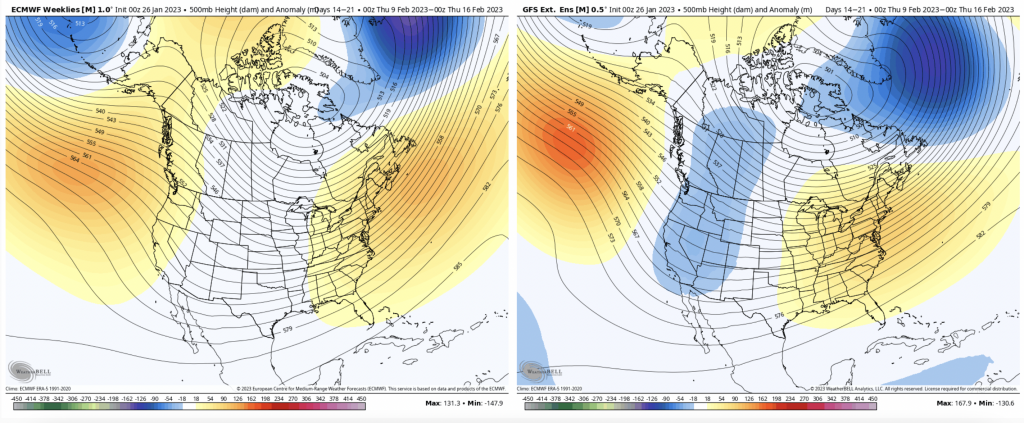

Days 14-21:

There’s a slight rebound in temperatures for the middle of the month. This is expected after an arctic outbreak, and couple weeks of cold. The Euro is staying a bit more middle of the road, which makes sense as its cold outbreak was less amplified. The GFS has a harder swing in the other direction since it was stronger. Therefore their individual progressions make sense.

The good news is that there’s no indication of major warmth coming into the first half of February.

Another large difference – the storm track would be vastly different in the Euro vs GFS (Euro much more favorable). With so many discrepancies in the relative short-term, I’m not going to get too involved in digging through the details here. One take home message, however, is that the pattern looks to be quite active in either of these scenarios.