Volatility continues to be the norm as we head through this week and the coming weeks. While El Niño is very slowly declining in the equatorial Pacific, the changes are likely not to be felt until mid-late March globally. The MEI index fell for December/January back to a weak El Niño, so they’re more likely to come in line toward the end of the season.

Nonetheless, vacation weeks should prove to be overall favorable with minor storm events and some cold. In the short term, weak low pressure systems brought snow from Virginia to New York over the past several days. In addition, upslope snows continue in the favored slopes of the Adirondacks and Greens, providing substantial snowfall for some. This continues through Sunday & Monday.

To the long term…

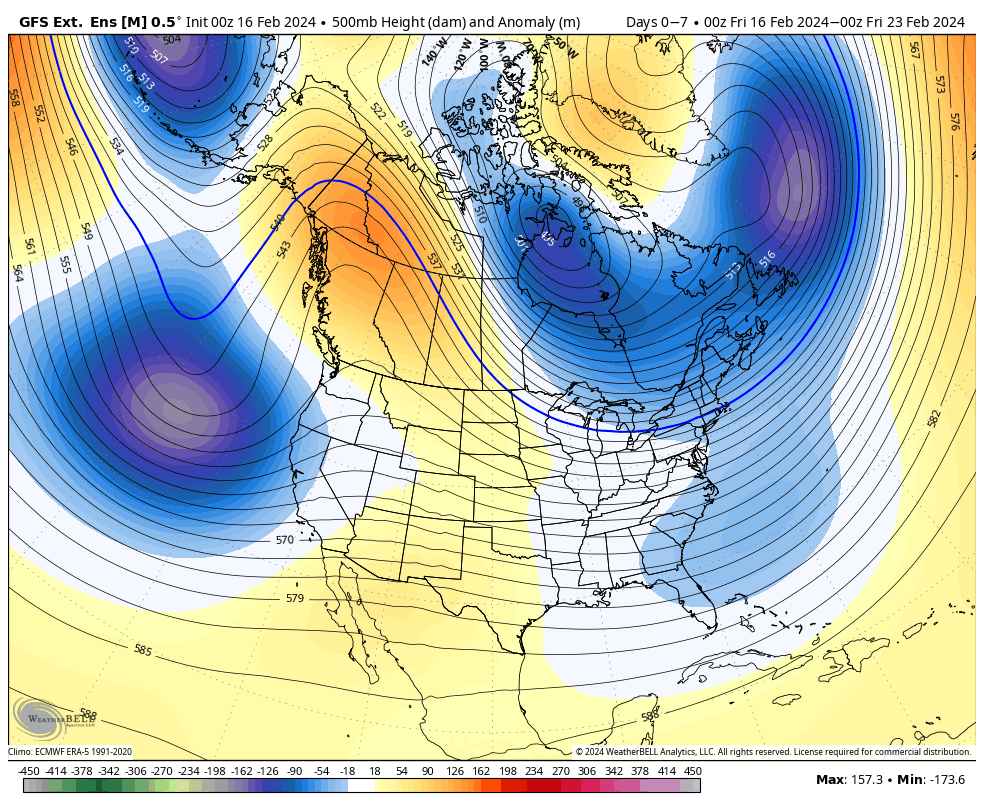

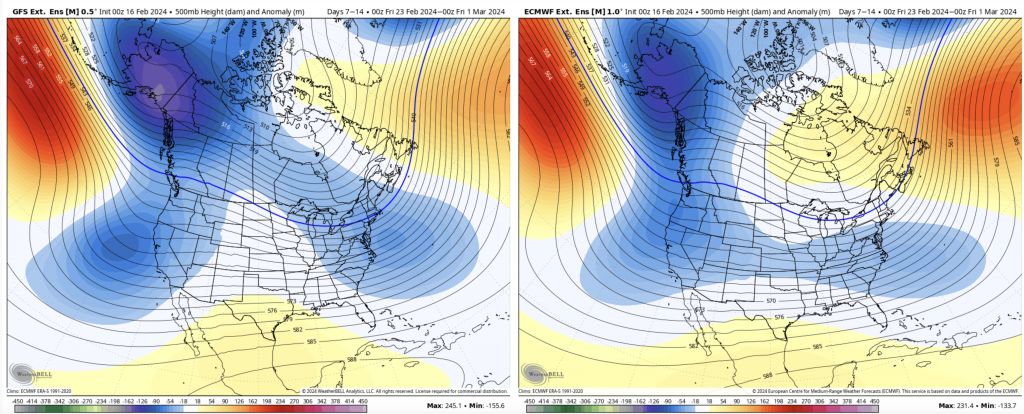

For Days 7-14, we have an elongated trough with a weak Omega look to it closing out February. The teleconnections at this time are not terribly exciting — we have a positive AO/NAO and positive to negative PNA, which likely means some more sustained moderation in temperatures toward the end of this period, and overall dry spell.

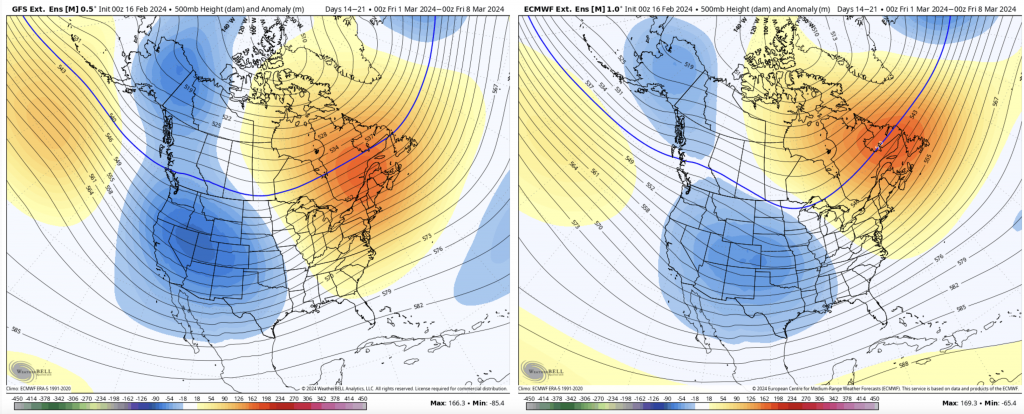

Going into Days 14-21 however, we’ll be coming down from this moderation. The overall pattern does not look promising from the 500mb outlook, but the teleconnections say that we should have another return to winter around March 5. The AO/NAO/EPO all trend negative and the PNA sneaks back to neutral/slightly positive.

The Euro is a little quicker in this transition, apparent in the right image as the highest heights are pushed to the Canadian Maritimes. Perhaps another miracle March on our hands? We shall see, but given the El Niño drop into early spring, I would not be surprised with an interestingly active late March through April pattern.